Term vs Whole Life Insurance: Pros and Cons

What Is the Key Difference Between Term vs Whole Life Insurance?

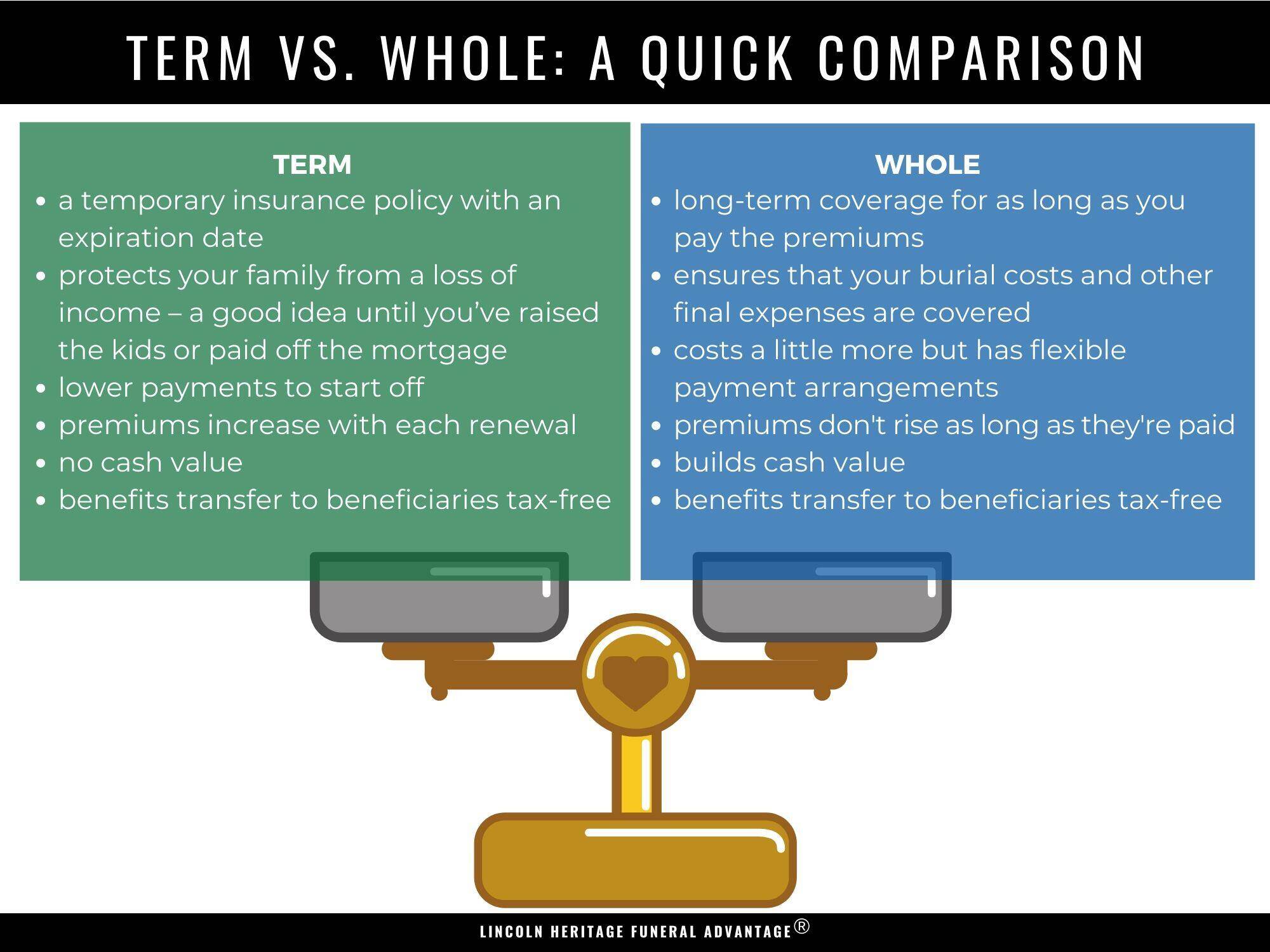

Term life and whole life insurance are both insurance policies that allow you to leave a cash benefit for your beneficiaries after you pass. Term life is a temporary insurance policy that is less expensive but has an expiration date. Whole life insurance builds cash value and costs a little more, stays in force for the life of the insured as long as the premiums are paid

Why Do You Need Term or Whole Life Insurance ?

Before you decide between term vs whole life insurance, first determine your needs and what you want the insurance to do. Are you looking for an insurance policy that protects you and your family from a life event, such as the loss of income from your death, or are you looking for more comprehensive protection?

Answering this question is important because the coverage amount for term and whole life policies can vary greatly based on several factors, such as the policy’s cost and qualification requirements.

If you are looking for something to help cover your final expenses, a specific type of whole life insurance called final expense insurance (also known as burial insurance or funeral insurance) may be best, depending on your age. But if you’re looking to protect your family from a loss of income, a term policy may be better suited.

Your circumstances and needs will determine which type of life insurance is right for you.

Term vs Whole Life Insurance: Quick Comparison

There are some significant differences in term life insurance and whole life insurance. Check out the table below to learn the basic differences.

Table of Contents

Term vs Whole Life Insurance Definitions

Shopping for life insurance can be confusing if you’ve never investigated it or haven’t purchased it before. This can be especially true when comparing term vs whole life insurance. But while the two types of policies both leave benefits after you’re gone, they are very different.

Understanding these differences is crucial to picking a life insurance policy that’s right for you and your family. Knowing the pros and cons of each will help you make an informed choice and protect what matters most. Let’s look at them now.

What Is Term Life Insurance?

Term insurance covers a fixed span of time – or term – and is generally considered temporary insurance. The term can last as little as one year, and you can scale it from there depending on the provider. The average span of a term life insurance policy is between 10 and 20 years, but the term can also cover someone until they reach a specified age.

These policies generally pay the death benefit if you pass during the term of the policy. But if the policy expires before you pass, the insurer will not pay the death benefit. In other words, when you buy term life insurance, you are only covered for the period of time that you pay the premiums.

If the term of the policy ends before you pass, then the policy typically expires and the insurer won’t pay a death benefit. Fortunately, some term insurance policies are more flexible:

- Renewable term – A renewable policy typically allows you to renew for a set period of time when the policy expires.

- Convertible term – A convertible policy typically allows you to convert the insurance to a different plan.

To qualify for term life insurance, you may have to take a medical exam, sometimes called a life insurance exam. Medical exams are often required because the coverage amounts are high. Because term life insurance is straightforward and doesn’t accumulate cash value, the premiums are relatively low (depending on your age and overall health) compared to whole life insurance.

The reason you can find lower premiums for term life insurance policies is that the coverage is only good for a specific period of time. But term life insurance premiums depend on several factors. For instance, they will vary depending on whether you are a smoker or non-smoker, your age, and any pre-existing health conditions you may have.

Term Life Pros & Cons

If you plan to purchase term life insurance, you should know that it has pros and cons. Here are some to consider before purchasing this type of life insurance:

| Pros | Cons |

|---|---|

| Lower premiums when you’re younger | It’s temporary coverage |

| Beneficiaries will receive larger death payouts | Must re-qualify at the end of the term |

| Can be converted to whole life insurance | Difficult to qualify if there is a significant health issue |

| – | Premiums can go up every time you take out a new term |

| – | Policy accumulates no cash value

|

What Is Whole Life Insurance?

Sometimes called permanent insurance, a whole life insurance policy provides coverage for your entire life as long as you pay the premiums. This type of insurance can accumulate cash value, which builds up in the policy as you pay your premiums. Depending on the provider, you can withdraw a policy’s cash value in the form of a policy loan or apply it toward the policy’s premium. Any unpaid policy loans will be subtracted from the death benefit.

Whole life policies pay death benefits to the primary beneficiary when you die. Unlike term plans, whole life policies provide coverage for your entire life. As long as the premiums are paid, the policy stays in force until you pass.

Another advantage of whole life insurance is that the policy premium is locked in for the life of the policy. This feature is important because typically life insurance costs more as you age and can be harder to qualify for. Locking in an affordable premium early can make a difference in affording life insurance as you get older.

Depending on the provider, most whole life policies don’t require a medical exam to qualify, you just answer a few health questions. This may make it easier to qualify if you have health issues.

Whole Life Pros & Cons

Just as with term life insurance, whole life insurance has its pros and cons. Here are some to consider:

| Pros | Cons |

|---|---|

| Builds cash value | More expensive than term life insurance |

| Premium amount is fixed | Smaller death benefit |

Term vs Whole Life Insurance Cost Comparisons

Here are some examples of term life and whole life insurance premiums*.

| Male 10-Year Term Life Insurance ($250,000) vs Whole Life Insurance ($10,000) | ||

| Age | Term Life | Whole Life |

|---|---|---|

| 50 | $27.50 | $30 |

| 55 | $41.80 | $35 |

| 60 | $69.95 | $43 |

| 65 | $109.65 | $56 |

| 70 | $184.04 | $74 |

| 75 | $357.11 | $100 |

*Rates do not reflect any particular insurer.

| Female 10-Year Term Life Insurance ($250,000) vs Whole Life Insurance ($10,000) | ||

| Age | Term Life | Whole Life |

|---|---|---|

| 50 | $22.47 | $25 |

| 55 | $33.67 | $28 |

| 60 | $56.33 | $33 |

| 65 | $109.65 | $41 |

| 70 | $182.05 | $52 |

| 75 | $357.11 | $72 |

*Rates do not reflect any particular insurer.

Term vs Whole Life Insurance Pros & Cons: Which Policy is Better?

To determine whether term life or whole life insurance is better for you, consider the following pros and cons of each.

| Benefits | Term Life | Whole Life |

|---|---|---|

| Builds cash value | no | yes |

| Stable premiums | no | yes |

| Long-term coverage | no | yes |

| Lower premiums | yes | no |

Term Life vs Whole Life Insurance: FAQs

Here are the answers to some of the most frequently asked questions about term life and whole life insurance.

Should I convert my term life to whole life?

Most term life insurance policies are convertible to whole life policies. When you convert from temporary insurance to whole life insurance, you will begin building tax-deferred cash value. You can take a cash value loan against the policy, withdraw the cash value or take the cash value should you decide to surrender the policy.

You can convert your policy if your life situation has changed or you retire. For instance, you may have a long-term dependent, such as a child with special needs. Or maybe you’ve always wanted whole life insurance but settled for term because the premiums cost less. But now your established career allows you to afford the increased premiums.

Should I buy both whole life and term life policies?

When you understand the difference between term vs whole life insurance policies, it’s easy to see how it might benefit you to have both types of policies. For instance, term life insurance may help prevent financial ruin for your dependents by ensuring financial obligations are covered in case you pass unexpectedly.

While term insurance is great for temporary needs, whole life insurance policies are a long-term solution. Both types of coverage can work together. A term policy is a good idea until you’ve raised the kids or paid off your mortgage. While a whole life policy, such as burial insurance, can ensure that your burial costs and other final expenses are covered.

What happens to term life insurance at the end of the term?

Term life insurance is temporary, so when the term ends so does the coverage. You can get term life insurance for a year or up to 30 years. When the policy term ends, coverage ends and must be reapplied for or converted to whole life before the expiration date.

Are whole life insurance policies worth it?

Whole life insurance provides stability and peace of mind because the coverage doesn’t end as long as the premiums are paid, and the premiums will never increase. There is no need to re-qualify after a term ends so any new health issues will not affect the coverage or premiums.

Can you cash in term life insurance?

Whole life insurance is the only type of life insurance that builds cash value. Term life doesn’t accumulate cash value so there is no surrender amount if you cancel your policy.

There are a lot of things to consider when deciding between term vs whole life insurance. Talk to your insurance agent about your current lifestyle, your plans for the future, and what you want your policy to cover to help you find the right plan for you.