What Is the Funeral Consumer Guardian Society®?

What is the Funeral Consumer Guardian Society®?

Every Lincoln Heritage Funeral Advantage® policy comes with a free membership to the Funeral Consumer Guardian Society®, an independent consumer advocate organization founded in 2000 to provide professional guidance to member families during the funeral planning process. The FCGS ensures families have the information they need to make informed decisions by reviewing funeral contracts and price-shopping local funeral homes on behalf of the family.

If you’re like most people, you may not know the average funeral cost is close to $10,000, and you probably don’t have any experience planning a funeral. Many people aren’t sure where to begin. Common questions include:

Since their founding, the FCGS has helped thousands of families across the country navigate the ever-changing funeral industry and find answers to these questions.

The FCGS was founded by Joe Kraft, a former funeral director whose family operated a funeral home for many years. The Kraft family has always been in the funeral business, all the way back to 1856, earning the trust of the communities they served by offering comfort and guidance to hundreds of grieving families.

Joe initially sold pre-need life insurance, a type of insurance product sold by funeral homes to fund a specific final arrangement at their establishment. Joe enjoyed some success selling pre-need insurance but soon ran into problems because the type of policy he was selling could only be used at a specific funeral home, making the customer’s options severely limited:

"The more I sold in the pre-need industry, the more I realized that final expense insurance was a superior type of insurance because the money could be used to fund a funeral anywhere in the world: it didn’t have to be used at a specific funeral home like my pre-need insurance." – Joe Kraft, President

After the Kraft family sold their funeral home in the late 1990s, Joe began working as an insurance agent for Lincoln Heritage Life Insurance Company® – the leading final expense insurance company in the country. Over the next several years, Joe realized a major shift had happened in the funeral industry. In the past, funeral homes were operated by families such as his, serving small communities and multiple generations within those communities. These mom-and-pop funeral establishments served an important role in the neighborhood, but a lot of them had been bought by large, publicly held companies like Service Corporation International.

When the large funeral corporations bought these funeral homes, the mom-and-pop funeral home name remained, but it now belonged to a nationwide chain. These large corporations now owned and operated thousands of local funeral homes across the country, and the personalized service that smaller family-owned businesses once offered was less common.

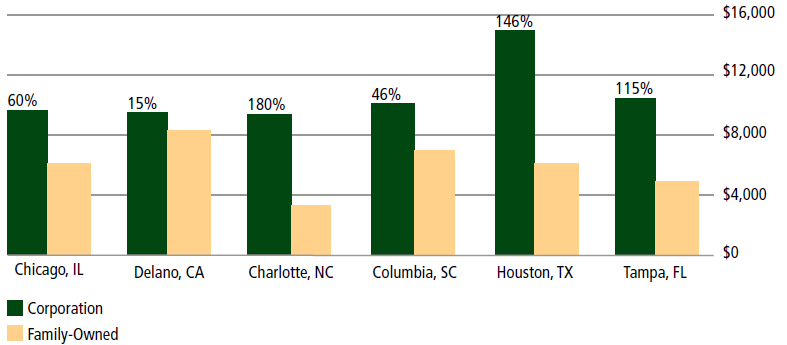

Historically, these corporations have higher prices than typical mom-and-pop funeral homes because they are concerned about one thing: return on investment to their stockholders. This focus on stockholders – not the grieving family – created an environment where customers were easily taken advantage of because they are so emotionally distraught that they don’t think through the pricing that’s being offered to them. On the worst day of their life, they’re willing to pay just about anything to give their loved one the best arrangements possible, and the funeral industry knows this.

Joe decided families needed someone on their side – someone who knew the ins and outs of funerals, cremations, and the industry as a whole – who would help them make informed choices. Joe knew from experience that most people don’t want to talk about dying and they certainly don’t know anything about caskets, embalming, or other common funeral items and services. Families needed to be able to focus on grieving, not price-shopping costs and coordinating all of the logistics that go into arranging someone’s funeral.

Thus, the Funeral Consumer Guardian Society was born.

As an independent consumer advocate organization, the FCGS’ mission is to help families save money on funeral costs. It’s unfortunate, but in the funeral industry there are funeral homes that overprice their products and take advantage of grieving families. Because the FCGS is not affiliated with any religion, funeral home, cemetery, or any particular funeral approach, it saves families an average of $1,850 on traditional funerals and up to $1,100 on cremation services.

When someone passes away, the family is distraught and grieving and they need help to deal with the funeral process; they aren’t in a position to price-shop funeral arrangements. Unfortunately, the reality is there’s a body that needs to be taken care of quickly. Time is not on the family’s side, and in most cases they simply go with the first funeral home they contact.

With the FCGS, you only have to make one phone call to get everything taken care of. You won’t have to call multiple funeral homes, and you won’t have to call multiple companies.

“What we do is more than just a job. We don’t hire just anyone. We have to find people that genuinely care about other people. We have to find people that believe in what we’re doing and want to help as many families as possible.” – Ben Kraft, Vice President

Here are some ways the FCGS helps its members:

Price-shopping funeral costs

The most important way the FCGS helps families is by price-shopping funeral costs. When it’s time to implement a member’s final wishes, the FCGS will help the family find affordable services that reflect the deceased’s wishes. The FCGS Personal Funeral Advisor does this by calling multiple funeral homes to get consumer families the best price possible.

People often don’t realize the difference in pricing from one funeral home to the next. For example, it’s very common for a direct cremation to cost $3,500 in New Albany, Indiana. But there are funeral homes that do the exact same service for $700. Large funeral companies that own several funeral homes in the community often have different prices for each one. Funeral Home A might charge $3,000 for a direct cremation and Funeral Home B might charge $3,700 even though they are owned by the same company. In these situations, the same funeral director often works at both funeral homes and the body will be sent to the same crematory no matter which funeral home you choose. Your price really just depends on what phone number you call and which funeral home you contact.

Budget is often an issue and a family may only have $6,000, but they want services and items that total $10,000. The FCGS can contact multiple funeral homes and help them find items online. For another family, they may have $10,000 but they want a direct cremation which may only cost $2,000. In a case like this, the FCGS can still help them save money because they know they can contact multiple funeral homes and try and get a better price.

Education of the funeral buying process

The FCGS prides itself on educating their members about all of the different options they have when planning a funeral. Families may not realize the difference between an 18-gauge casket and a 22-gauge casket or that most casket manufacturers can paint their caskets the same colors you see in the funeral home. The FCGS helps ensure families understand all of their options so they can make an informed decision. Most of the time, it’s simply a matter of explaining the different ways a family can purchase common funeral items. For example, families can often save hundreds of dollars by purchasing a casket online through a third-party retailer instead of buying directly from the funeral home.

Below are some common funeral items and the different options that may be available to you.

Traditional Funeral Items

- Casket: 20-gauge steel, or pine

- Grave liner: concrete box with drain holes (no sealing abilities)

- Transportation: casket coach, clergy coach, and flower car

- Flowers: casket spray and lid piece

- Casket: 18-gauge steel, or oak

- Burial vault: concrete top seal with plastic liner or steel air seal

- Transportation: casket coach, clergy coach, and flower car

- Flowers: casket spray and lid piece

- Casket: 16-gauge stainless steel, or maple

- Burial vault: concrete seal with stainless steel liner or galvanized steel air seal

- Transportation: casket coach, clergy coach, limousine and flower car

- Flowers: casket spray and lid piece

Traditional Cremation Items

- Direct cremation, including removal and shelter of remains

- Transportation to crematory, no memorial visitation

- Alternative urn for ashes

- Direct cremation, including removal and shelter of remains

- Memorial visitation and funeral service without the body present

- Standard urn

- Traditional funeral with cremation as the final disposition of the body

- Memorial visitation and funeral service with the body present

- Custom urn or jewelry

Funeral contract review

Funeral homes appreciate the services the FCGS provides because they are able to assure the funeral home that funds are available to pay the bills. Because the FCGS only works with Lincoln Heritage Life Insurance Company, they are able to get funds paid quickly to the funeral home. Funeral homes also appreciate the FCGS’ involvement because they know the family understands what’s going on, what needs to be decided, how it needs to be paid for, etc. The funeral home doesn’t have to worry about educating the family on what to expect throughout the process.

Once a funeral home has been selected, the FCGS will review the funeral contract to make sure all pricing information is accurate, and that all of the goods and services are accounted for. Here’s one example of how this contract review saved a family $1,500:

“A family out of Las Vegas, Nevada was getting ready to pay the final funeral bill when they noticed a $1,500 discrepancy between what it was supposed to cost and what they were being charged. So they called us and we found out there was a $1,500 charge for something called a ‘casket key.’ We had never heard of a casket key before because the only thing that opens and closes a casket is a specific sized Allen wrench, which costs about 99₵. So we called the funeral director to see what was going on. The funeral director immediately took the charge off and chalked it up to a ‘clerical error.’ But if we had not called, that family would have paid an extra $1,500 and never been wiser.” – Joe Kraft, President

Final wishes documentation

When someone dies, there are countless funeral preparations that need to be made so everything can go as smoothly as possible. The FCGS helps its members proactively document their final wishes prior to the time of need, ensuring surviving loved ones have funeral plan to follow. This eliminates confusion over what the deceased would have wanted and helps prevent arguing among family members.

Allowing its members to plan their final wishes in advance not only saves surviving family members money, but it saves them from the stress and anxiety that comes with coordinating all of the final arrangements. With the FCGS, there’s no second-guessing your loved one’s final wishes and family members are grateful when they find out their loved one documented their wishes before they passed.

Members don’t have to worry about their loved ones arguing over who gets what, what the service looks like, or whether to have a burial or cremation because it’s all documented. One phone call to the FCGS gives the family the exact final arrangements the deceased wanted.

The federal government got involved in the funeral industry in the 1980s because there was so much abuse and secrecy within the industry, especially with regard to pricing and ensuring consumers knew what they were purchasing.

The Federal Trade Commission (FTC) created the Funeral Rule to help families get honest information upfront from the funeral home. It requires funeral homes to create a General Price List (GPL), disclose pricing information over the phone, and it ensures all funeral homes offer the same 16 items on their GPL (things like professional service charges, cosmetology fees, embalming fees, transportation charges, etc.).

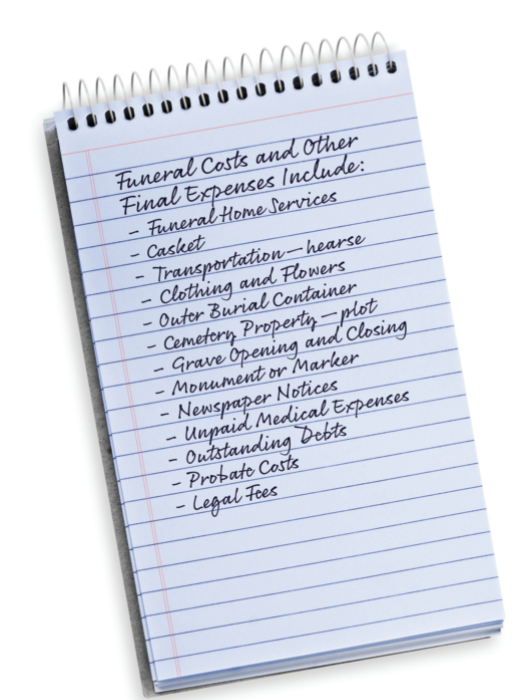

Funeral costs often include:

Keep in mind that the Funeral Rule does not apply to cemeteries. Some people think they can save their family money by buying a cemetery plot in advance. What they don’t realize is that cemeteries charge large opening and closing costs for their plots. A lot of cemeteries are owned by large funeral home corporations and most don’t explain what their opening and closing charge is. Buying cemetery plots in advance can cost surviving family members thousands of dollars when it’s time to lay the body to rest.

The cost of dying is expensive for a family: long-term health care, prescription drug costs, hospital stays, hospice care, etc. These all take a toll on a family’s finances. Most people go through all of their resources going through the dying process. That’s why final expense insurance is so important. Sometimes, it’s all a family has left to pay for the final arrangements.

For many years, Lincoln Heritage Life Insurance Company and the Funeral Consumer Guardian Society have worked together as partners to ensure consumers have the funds they need and are treated fairly when planning a funeral. The FCGS’ background in funeral services, combined with their knowledge of what’s going on in the industry and how families are taken advantage of, made them the perfect fit for Lincoln Heritage’s fast claims service.

The Funeral Advantage program provides a small life insurance policy from Lincoln Heritage Life Insurance Company plus funeral planning services from the Funeral Consumer Guardian Society. The FCGS acts as an advocate for the consumer, helping the family work within their budget to find services they can afford, protecting them from rising funeral costs, and ensuring the member’s funeral preferences are respected. Funeral Advantage is the only final expense life insurance program that includes a free membership to the FCGS.

“When the Funeral Consumer Guardian Society first started, we found a big problem in our ability to help families; we could give the member advice, but we had no leverage to lower the price. We decided to partner with Lincoln Heritage to get the leverage the family needs in order to purchase merchandise and services from outside the funeral home. They are the only life insurance company we work with because we need the money fast - and Lincoln Heritage is the fastest when it comes to paying claims in our experience. This, along with their educated, enthusiastic salesforce, excellent customer service, and competitive prices allows us to offer a complete package to the individual that wants to protect the ones they love.” – Ben Kraft, Vice President

The Funeral Advantage program has two key components: a life insurance cash benefit from Lincoln Heritage and family support services from the FCGS.

Following the death of a Funeral Advantage policyholder, cash benefits are paid within 24 hours of claim approval by Lincoln Heritage while the FCGS assists the family with getting all of the information they need for planning the funeral, including a list of the policyholder’s final wishes. Part of the family support services includes educating the member’s family about all of the different options they have.

Funeral Consumer Guardian Society Member Testimonials

“One of our members was from Wichita, Kansas. His wife called us because she had gone through almost 100% of her resources taking care of her husband before he passed. All she had was a Funeral Advantage policy worth $5,000. She wanted to have a traditional service (visitation, hearse procession, committal service at the cemetery, etc.). It’s difficult to find all of that for $5,000, but in her town we were able to do it. In addition to her Funeral Advantage policy, she owned cemetery property. She assumed there would be no cemetery costs since the property had already been paid, but we knew we had to call the cemetery to find out how much the opening and closing charge would be. We found out the cemetery was going to charge $2,700 to dig the grave. With no funds to cover this cost, it was impossible for her to use the cemetery plot. We ended up calling several cemeteries in the area and we were able to get her a plot for $400 with an opening and closing charge of $300.” – Joe Kraft, President

Hear real families talk about the Funeral Advantage program and the FCGS in the video below:

Become a Funeral Consumer Guardian Society Member

The funeral industry is constantly changing and families may be at risk if they don’t have a trusted partner to help them through this highly emotional time.

That’s why Funeral Advantage was created. It’s the leading final expense program in the country and the only life insurance policy that comes with a free membership to the FCGS. The FCGS has saved policyholder families millions of dollars on funeral costs over the years.

If you’re interested in protecting your family when you pass away and getting a free membership to the Funeral Consumer Guardian Society, learn more about the benefits of Funeral Advantage.