Are Funeral Expenses Tax Deductible?

Funeral expenses aren’t tax deductible for individuals, and they’re only tax exempt for some estates. Estates worth $11.58 million or more need to file federal tax returns, and only 13 states require them. For this reason, most can’t claim tax deductions. Plus, the values of estates that have to pay federal or state taxes are very high, so claiming funeral expenses is fairly uncommon. As always, it's best to consult a tax professional when making tax-related decisions.

Which Estates Can Claim Federal Tax Deductions for Funeral Costs?

Not every estate pays federal taxes, so many can’t get tax deductions on funeral costs. The Internal Revenue Service (IRS) requires those with gross values of at least $11.58 million to file federal tax returns using the IRS Form 706.

You can figure out an estate’s gross value by adding up the value of assets owned by the person who passed away. If the total is less than $11.58 million, you don’t need to file a federal tax return, so you can’t claim any funeral expenses.

Which Estates Can Claim State Tax Deductions for Funeral Costs?

Some states require estates to pay taxes even if they don’t file federal returns. Each one has a different value for which estates need to file a return, but none is as high as the federal amount.

| State | Gross Value of Taxable Estates |

| Connecticut | Over $5.1 million |

| Hawaii | Over $5.49 million |

| Illinois | Over $4 million |

| Maine | Over $5.8 million |

| Maryland | Over $5 million |

| Massachusetts | Over $1 million |

| Minnesota | Over $3 million |

| New York | Over $5.85 million |

| Oregon | Over $1 million |

| Rhode Island | Over $1.58 million |

| Vermont | Over $4.25 million |

| Washington | Over $2.19 million |

| Washington, DC | Over $5.68 million |

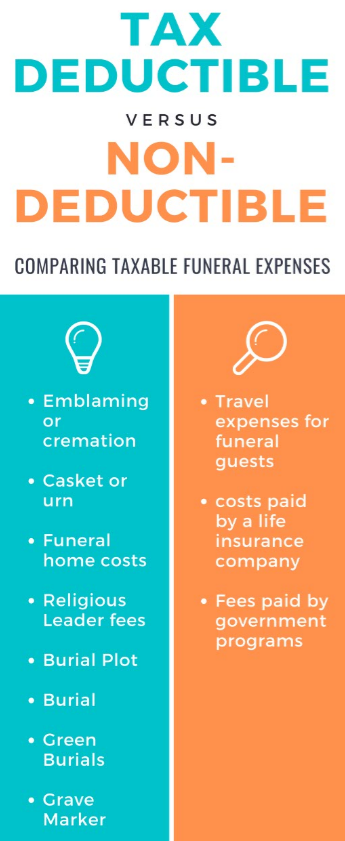

Which Funeral Expenses Are Tax Deductible?

- Embalming or cremation

- Casket or urn

- Funeral home facility costs

- Funeral home director fees

- Funeral service arrangement costs, including floral and catering services

- Transportation costs for the deceased and their immediate family members, including hearse and limousine services

- Minister, rabbi, or other religious leader eulogy fees

- Burial plot

- Burial (interment)

- Green burials

- Tombstone, gravestone, or other grave marker

You can deduct expenses paid with estate funds. You can’t claim costs paid by the executor, the next of kin, or a burial or funeral insurance policy.

Keep receipts to prove the estate paid these fees. This way, you won’t run into any problems if you’re audited by the IRS.

Note that the IRS may not accept all of your requested write-offs. Funerals cost an average of about $9,000, so the IRS may not honor every claim for more expensive funeral services and receptions.

Funeral Expenses that Aren’t Tax Deductible

Some funeral costs are personal expenses. They’re not eligible for tax deductions by the estate, and individuals can’t claim them on personal tax returns. These include:

- Travel expenses for funeral guests

- Costs paid by a final expense insurance policy or other life insurance policy

- Fees paid by government programs or other grants, such as burial benefits paid by the Veterans Administration (VA) or the Social Security Lump Sum Death Benefit

How to Claim Tax Deductions for Funeral Expenses

Executors can claim tax deductions by completing Schedule J on IRS Form 706. Always consult a tax professional before completing any IRS forms. Use these steps to claim write-offs for funeral expenses:

- Go to Schedule J on page 17.

- Enter your itemized funeral costs on line 1 of Section A. These are the costs discussed in the “Which Funeral Expenses Are Tax Deductible?” section of this guide.

- Write the total on the “total funeral expenses” line.

You’ll need to add this number to fees that aren’t related to the funeral. Use these steps to get your final tax deduction amount:

- Add your administration expenses for settling the estate to lines 1 - 3 of Section B on page 17. These are the costs of executor, attorney, and accountant fees.

- Itemize your miscellaneous expenses on line 4. These are other costs paid to settle the estate.

- Add these total costs to the value of “total funeral expenses.” Write the amount at the bottom of the Schedule J page and on line 14 of page 3.

Estates that earned income are sometimes also required to file income tax forms using IRS Form 1041. However, these forms aren’t used to claim funeral-related tax deductions.

FAQs

Which Estates Can Claim Tax Deductions on Funeral Expenses?

Not all estates need to pay taxes, so only those of certain values can claim tax write-offs for funeral and burial costs. Estates worth at least $11.58 million must pay federal taxes. Estates with lower values may have to file state tax returns, depending on their location.

Can Funeral Expenses Be Claimed on a Deceased Person’s Final Tax Return?

No. The decedent’s final tax return isn’t eligible for any funeral-related tax write-offs.

Are Funeral Expenses the Same as Medical Costs?

Individual taxpayers can claim certain medical expenses on their returns, but funeral expenses aren’t medical costs. Qualified medical costs are those that treat or prevent illnesses and other conditions. They include:

- Doctors’ fees for primary care physicians (PCPs), dentists, opthamologists, and other specialists

- Hospital expenses

- Medical equipment

- Prescription medication

- Home care, nursing home, and assisted living facility fees that aren’t covered by a senior life insurance policy